can you owe money in stocks on robinhood

The value of your investment will decrease but you will not owe money. For example a stock with a dividend yield of at least 725 will throw off enough income over a decade to double an investors money.

Pin By Gunther Anton On Gentleman Smart Shopping Young Professional Business Man

The margin investing feature allows you to borrow money from Robinhood to purchase securities.

. Some beginners think you only get taxed for when you withdraw the money from your Robinhood account to your bank. For example you might own a house thats worth 300000. Any money you take out of a traditional retirement account is taxed at your ordinary income rate at the time you withdraw.

But you must make sure to hold your I Bond for at least five years. For example if you buy 100 shares of a stock at 25 per share and later sell them for 40 per share you will have realized a capital gain of 15 per share or. You would fill out schedule D with the appropriate information which includes whether its a short or long term capital gain or loss.

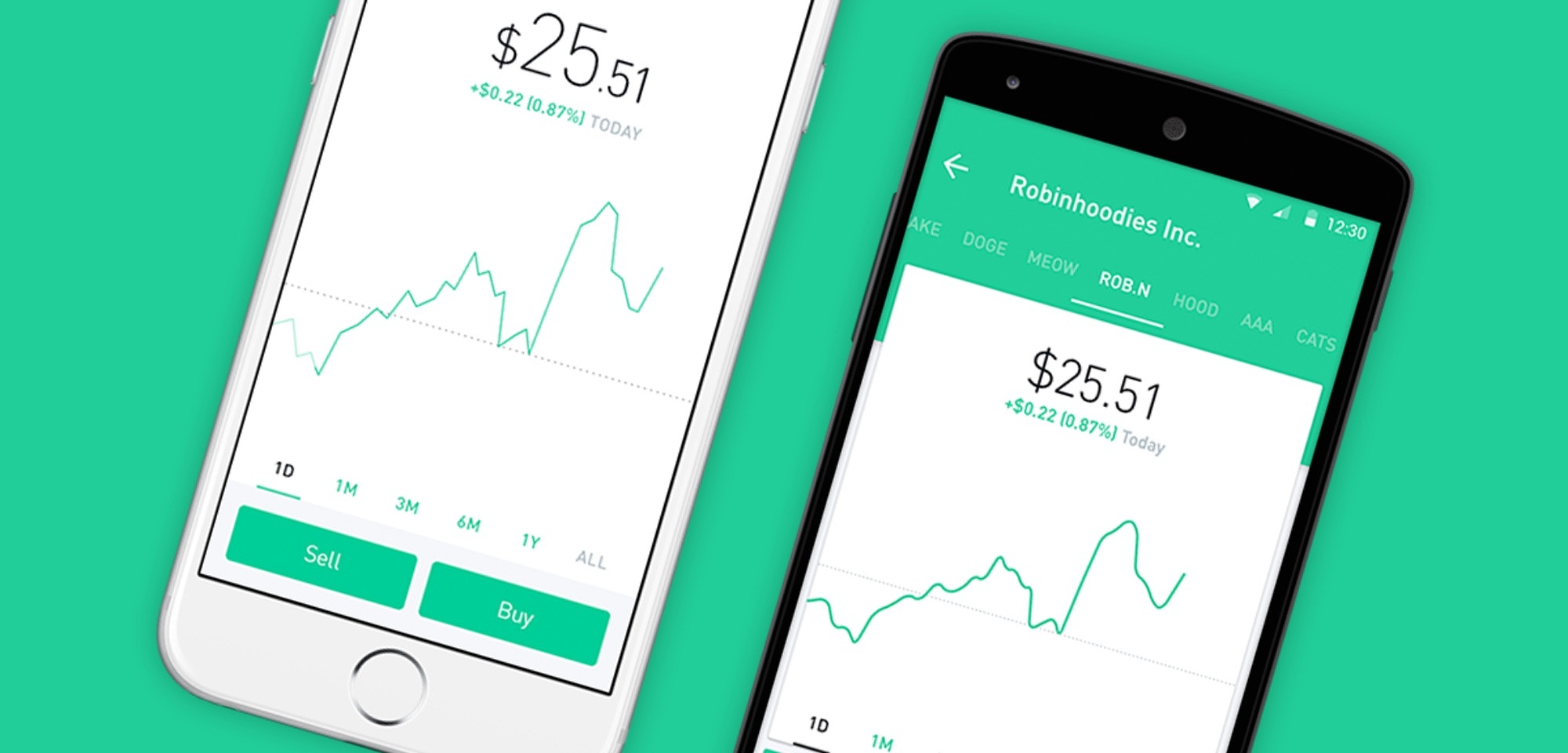

Department of Labor kids cant legally take on their first job for an employer until theyre at least 14-years-old. He liked the free stocks he got from referring more than a dozen friends and found it easy to trade on his phone. Robinhood is an investing app that launched in 2015.

If you sold and realized gains of 50 dollars you are required to claim it on your taxes. If you didnt get all of the mortgage documents in or you moved money around or your credit score changed in the process all of those. If you earned money in your brokerage account last year it could have an impact on your 2021 tax return which youll need to submit by.

25 Best Ways. This gives you access to additional money based on the value of certain securities in your account. And if you take money out before turning 595 youll owe a.

But watch out for the wash-sale rule. Thank you for the dollops of money made for me Naman Kapoor. The best part is just pick up the phone and talk and you can have a conversation with one of the finest minds in the investment world.

TD Ameritrade review. 3 Highly Profitable Stocks to Buy That Wall Street Thinks Can Soar 80 to 90 Their businesses continue to make lots of money. According to the US.

When we the members have already got returns of 60-70 that is the time the rest of the world starts to. If you invest in stocks with a cash account you will not owe money if a stock goes down in value. If you own another stock that gained 15 a share you can sell both stocks and owe taxes only on the 5 a share difference.

Its popular among millennials who make up a majority of its users and can conduct a variety of investments for free. The case should serve as a loud warning for the new crop of do-it-yourself investors. The money you made from dividends will be added to your earned income.

But that doesnt mean your child cant start finding ways to make money before then. Capital gains as they pertain to stocks occur when an investor sells shares of an individual stock a stock mutual fund or a stock ETF for more than they originally paid for the investment. Selling it earlier results in a penalty.

Dividend stocks have historically been great wealth creators. Thanks to the internet there are more opportunities for kids to make. Well you only owe taxes on investments that you sell not investments that happen to increase in value over the course of time.

Whenever you make a stock sale you might owe taxes on that transaction. But if you still owe the bank 250000 on your mortgage you have to subtract that number out which means thats only 50000 going towards your net worth. Recently however he has stopped trading in.

What are capital gains taxes. The family of a 20-year-old student says he died by suicide after confusion over an apparent negative balance of 730000 on his Robinhood account. Margin investing can provide flexibility with your cash.

A Robinhood newbie is facing a potential tax bill of 800000 despite only making 45000 in net trading profits. Box 1a shows you the total ordinary dividends you received and Box 1b shows you. Once you take advantage of this.

If you do owe taxes on your earnings you may defer them for up to 30 years. London In the stock market if someone is ahead of times it is Prudentequity. This is a terrible mistake that can come back to bite you.

And while both long-term stocks owned for more than 12 months and. Choose if youd like to sell in dollars or shares using the drop-down menu. If you see an opportunity in the market and want to invest more you can invest right away without needing to make a deposit.

How to Pay Taxes on Stocks Whether you are a long-time investor or you are just picking your first brokerage you will owe money for your capital gains. Click Sell in the order window on the right side of the screen. What is Robinhood.

Navigate to the stocks detail page. You will pay taxes on stocks when you file. The stock is trading at around the 15 level roughly six.

How To Make Money as a Kid. The first two boxes or columns depending on how your form is laid out of 1099-DIV forms deal with dividends. And analysts think the stocks could make investors a lot of money too.

Now they are demanding answers from the. Answer 1 of 9. Every time you sell a stock ETF or cryptocurrency you will incur what the IRS considers a taxable event.

If you buy stock using borrowed money you will owe money no matter which way the stock price goes because you have to repay the loan. Shares of Robinhood seen by some as a proxy for retail investors are down 21 year-to-date. If you held the stock for longer than a year you have.

Here you can find the stocks historical performance analyst ratings company earnings and other helpful information to consider when selling a stock. When you calculate your total assets take into account the total value of everything you own. If the estimator says that your home is worth 250000 and you still owe 150000 the estimated equity in your home would equal.

There are a few tax documents that the IRS uses to calculate what you owe.

/GettyImages-932632502-b83a7730479048b4b68266b1f34a47c0.jpg)

What Happens When A Stock Broker Goes Bust

/images/2020/06/29/pensive-woman-looking-at-laptop-screen.jpeg)

Can You Lose More Than You Invest In Stocks The Answer May Surprise You Financebuzz

Margin Account Vs Cash Account Which Is Better For Traders

Small Cap Stocks Turn Out Best Performers Of 1h 5 Top Picks In 2021 Small Cap Stocks Research Images High Deductible Health Plan

Can You Ever Owe Money Be In Debt When Share Trading Quora

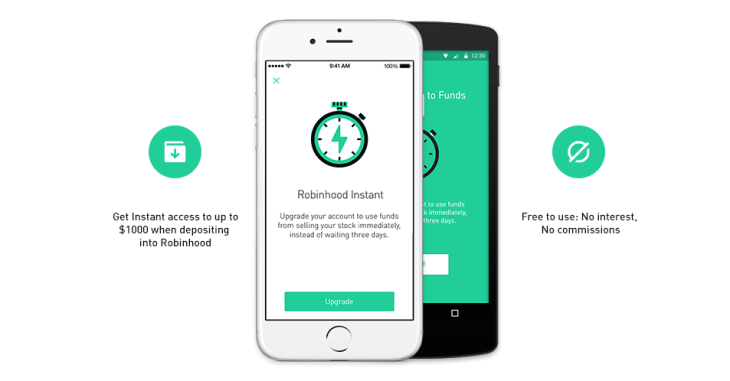

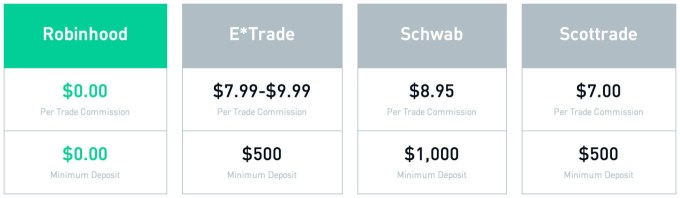

Robinhood Ditches 3 Day Wait Fronts New Users 1000 To Buy Stocks Techcrunch

Top 10 Option Trading Mistakes Watch How To Trade Smarter Now Ally

Best Penny Stocks To Buy Under 1 On Robinhood Right Now

Robinhood Ditches 3 Day Wait Fronts New Users 1000 To Buy Stocks Techcrunch

Robinhood Review The Best Way For Beginners To Trade Stock

How I Pick My Stocks Investing For Beginners Youtube Investing Finance Investing Investing In Stocks

Just Opened A Robinhood Account 3 Things You Should Know The Motley Fool

High And Low Reversals Indicator Day Trading Strategy Usethinkscript Trading Quotes How To Get Rich Trading Strategies

5 Things Not To Do In The Robinhood App For Stock Trading By Jen Quraishi Phillips Medium

Robinhood Backlash What You Should Know About The Gamestop Stock Controversy Cnet

The Tax Moves Day Traders Need To Make Now Day Trader Moving Day Capital Gains Tax